Enterprises often handle large volumes of bank statements that need to be reviewed, adjusted, and shared across departments. Whether for reconciliation, audits, or reporting, having the ability to securely edit these documents is essential.

Use Cases for Editing Bank Statements

Editing bank statements isn’t just about fixing numbers—it supports a wide range of financial operations across departments. Here are some use cases for editing bank satements.

Financial Operations & Reconciliation

-

Correcting transaction categorization

Teams often need to reclassify transactions (e.g., from “miscellaneous” to a specific expense category) for accurate bookkeeping. Editable PDFs allow these changes without switching tools or formats. -

Consolidating multi-account data for internal reports

Financial departments managing multiple bank accounts may merge statements into a single document to track company-wide cash flow, flag inconsistencies, or prepare summary reports for stakeholders.

Audit Preparation and Compliance

-

Highlighting entries, adding annotations

During internal or external audits, finance teams may need to draw attention to specific transactions or explain irregularities directly on the PDF using annotations or sticky notes. -

Masking sensitive data during third-party audits

Some audits require sharing statements while protecting confidential information (e.g., client names, private notes). Redaction tools help remove or block out such data before sending files to external parties.

Client and Partner Reporting

-

Customizing bank statements for investor briefings or client summaries

When preparing financial overviews, teams often edit or summarize bank statements to highlight only relevant sections or group transactions into categories that align with the presentation format. -

Removing irrelevant data before distribution

Statements sometimes contain pages or entries that aren't relevant to the recipient. Being able to delete, rearrange, or hide these sections improves clarity and professionalism in shared documents.

Jane Doe

Jane Doe

Risks of Improper Editing Practices

From data errors and compliance violations to security risks and workflow confusion, poor editing practices can compromise both accuracy and accountability.

Data Integrity Issues

-

Manual edits without version control lead to errors

Without proper version tracking, teams risk working on outdated or conflicting versions of the same statement. Simple copy-paste errors or accidental overwrites can result in incorrect financial data. -

Lack of traceability in collaborative environments

When multiple people handle the same document without a structured workflow, it becomes hard to track who made changes, when, and why. This can lead to confusion during audits or financial reviews.

Compliance and Legal Concerns

-

Regulatory violations due to improper data handling

Financial data is subject to strict regulatory standards. Editing bank statements outside of approved systems can lead to non-compliance with rules like PCI DSS, SOX, or local banking laws. -

Potential breach of privacy laws (e.g. GDPR, SOX)

Exposing personal or client information during edits—especially in shared or cloud environments—can violate data protection regulations, leading to penalties or reputational damage.

Tool Fragmentation

-

Using PDF viewers, spreadsheets, and email chains

Switching between multiple tools to edit, verify, and share bank statements increases the risk of inconsistencies, data loss, or unauthorized access. -

No audit logs, user control, or document locking

Generic PDF editors often lack enterprise features like role-based permissions, document locking, or audit trails. Without these, organizations can’t ensure document authenticity or secure collaboration.

Admin Console

Admin Console Custom Business Stamps

Custom Business Stamps System Integration

System Integration Digital Signatures

Digital SignaturesHow LynxPDF Enables Secure Editing of Bank Statements

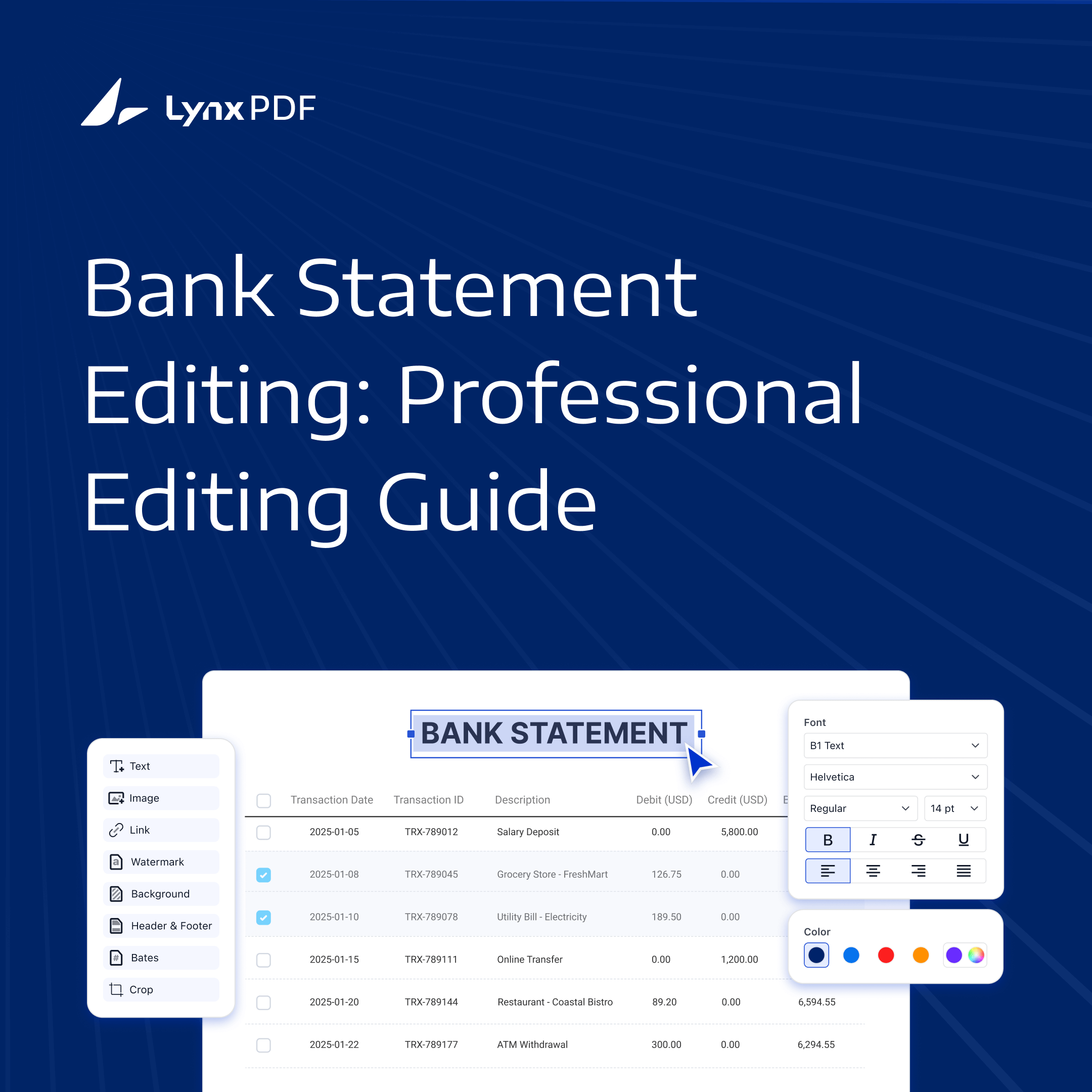

LynxPDF is built to handle sensitive financial documents with the precision and control enterprises need. It combines powerful editing tools with enterprise-grade security features, ensuring that every change is trackable, secure, and compliant with internal and regulatory standards.

Smart PDF Editing Tools

-

Intuitive interface for editing amounts, texts, comments, and metadata

LynxPDF makes it easy to correct or update figures, add explanatory comments, or adjust metadata fields—all within a clean, user-friendly layout designed for financial professionals. -

Batch processing of multiple statements

Instead of handling files one by one, teams can process large volumes of PDFs simultaneously. This is especially useful for institutions managing monthly statements across multiple accounts or clients.

Enterprise-Grade Security Features

-

Access controls, role-based permissions

Admins can define who can view, edit, or approve documents, ensuring only authorized staff can make changes or view sensitive financial data. -

Watermarking, redaction, and document versioning

Built-in tools let users redact private information, apply watermarks for distribution control, and maintain a full version history to track every change made.

Audit Trail & Document Integrity

-

Timestamped edits, logged changes, and exportable history

Every modification is automatically recorded with a timestamp and user ID, giving teams full visibility into the document’s lifecycle. These logs can be exported for audit or compliance purposes. -

Digitally sign or certify final versions

Once a statement is finalized, it can be digitally signed or certified to prevent further edits—preserving its integrity for compliance or official reporting.

Seamless Workflow Integration

-

Supports document collaboration in shared cloud environments

LynxPDF works well in collaborative setups, allowing teams to review, annotate, and approve bank statements in real time across departments or locations. -

API and CLI options for automated data injection

For high-volume environments, LynxPDF offers API and command-line tools to inject or extract financial data, streamlining integration with accounting systems or ERP platforms.

Jan Stiedemann

Jan Stiedemann

Best Practices and Tips

When working with PDFs, especially in a business context where accuracy and efficiency are paramount, there are several best practices and tips that can help.

Always Work on Copies — Never Originals

To prevent accidental data loss or unauthorized changes, edits should always be made on copies of the original statements. Originals should be stored securely and left untouched for audit and compliance purposes.

Log Changes and Maintain Version History

Track every edit made to a statement, including who made it and when. This creates a clear audit trail and ensures accountability, especially when documents pass through multiple departments or reviewers.

Follow Organizational Data Governance Policies

Editing bank statements should align with your company’s internal rules on data handling, access control, and record retention. This includes respecting access permissions and securely sharing edited files.

Use Purpose-Built PDF Tools Instead of General Editors

Generic PDF tools often lack financial editing features and security standards. A dedicated solution like LynxPDF ensures better control, accuracy, and compliance with enterprise requirements.

FAQ

Can bank statements be edited without breaking compliance rules?

Yes, if edits are made for internal purposes (e.g., formatting, annotation, redaction) using tools that maintain audit trails and follow data governance policies. Edits must not misrepresent or falsify financial data.

Is it legal to edit a PDF bank statement?

Editing for internal reporting, reconciliation, or auditing is allowed within an organization, provided it does not involve tampering with data for fraudulent purposes. Always consult legal and compliance teams when in doubt.

How does LynxPDF keep financial data secure?

LynxPDF offers role-based access control, encryption, redaction tools, version tracking, and digital signatures to ensure that documents are edited securely and meet regulatory standards.

What’s the difference between general PDF editors and LynxPDF?

General tools may lack audit logs, redaction, metadata control, or automation features. LynxPDF is designed for high-volume, regulated environments, making it more suitable for financial teams.

Can LynxPDF handle scanned statements?

Yes. It includes OCR capabilities to convert scanned bank statements into editable text, even if the layout is complex or multi-page.

Is there a way to automate edits or data extraction?

LynxPDF supports API and command-line integration, allowing teams to inject, extract, or batch-process data programmatically across multiple files.