How to Understand Liquidity in Life Insurance (With Explanatory Template)

A critical but not often explored part of life insurance is liquidity. Liquidity in life insurance refers to the ability to access cash from your policy during your lifetime.

Understanding this feature can help you make better decisions about your financial planning and life insurance strategy.

How to Think of Liquidity in Life Insurance

In the context of life insurance, liquidity is the cash value that policyholders can access while they are still alive.

Unlike term life insurance, which doesn't offer a cash value, permanent life insurance policies allow you to accumulate cash over time.

You can borrow against this cash value or withdraw it, making it a "liquid asset" that can be accessed for emergencies, education costs, or retirement planning.

How Does Liquidity Work in Life Insurance?

To understand liquidity, it’s essential to know the different elements of a life insurance policy that affect your ability to access cash:

- Cash Value

Permanent life insurance policies build cash value over time. A portion of your premium goes into a savings or investment component, which grows tax-deferred.

- Loans Against Cash Value

Most permanent life policies allow you to take out a loan against the cash value. These loans often have lower interest rates compared to traditional bank loans, and you don’t need to undergo a credit check.

- Withdrawals

Some policies allow you to make withdrawals directly from the cash value. However, withdrawals may reduce the death benefit and could have tax implications if the amount exceeds what you’ve paid in premiums.

- Tax Considerations

Accessing the cash value via loans is generally tax-free as long as the policy is in force, while withdrawals above the premium payments might be taxable.

Why Liquidity in Life Insurance Matters

Liquidity is important because it allows policyholders to use their life insurance policies as a financial tool, not just a safety net for beneficiaries. Here are some reasons liquidity is valuable:

- Financial Flexibility: You can use it to cover unexpected expenses, supplement your retirement income, or even fund a major purchase.

- Emergency Fund: Having access to liquid assets can provide peace of mind during financial emergencies.

- Tax Advantages: Loans against the cash value are typically not taxed, making it an efficient way to manage your wealth over time.

- No Penalties for Loans: Borrowing against your life insurance cash value typically does not incur penalties or early withdrawal fees.

Comparing Your Life Insurance Policy

To help you better understand and apply the concept of liquidity in life insurance, we’ve created an explanatory table for comparison.

| Category | Explanation | Your Policy Details |

|---|---|---|

|

Policy Type |

Identify if your policy is term or permanent. Only permanent policies offer liquidity. |

|

|

Cash Value Growth |

Check how your cash value accumulates over time and at what rate (e.g., fixed, variable). |

|

|

Loan Option |

Find out if your policy allows loans against the cash value and at what interest rate. |

|

|

Withdrawal Rules |

Understand the conditions under which you can withdraw cash and any associated fees or penalties. |

|

|

Surrender Charges |

Review if there are any charges or penalties for surrendering your policy early. |

|

|

Tax Considerations |

Determine the tax implications for loans, withdrawals, and surrenders. |

|

|

Liquidity Needs |

List your financial goals (e.g., retirement, emergency fund) and how liquidity can support them. |

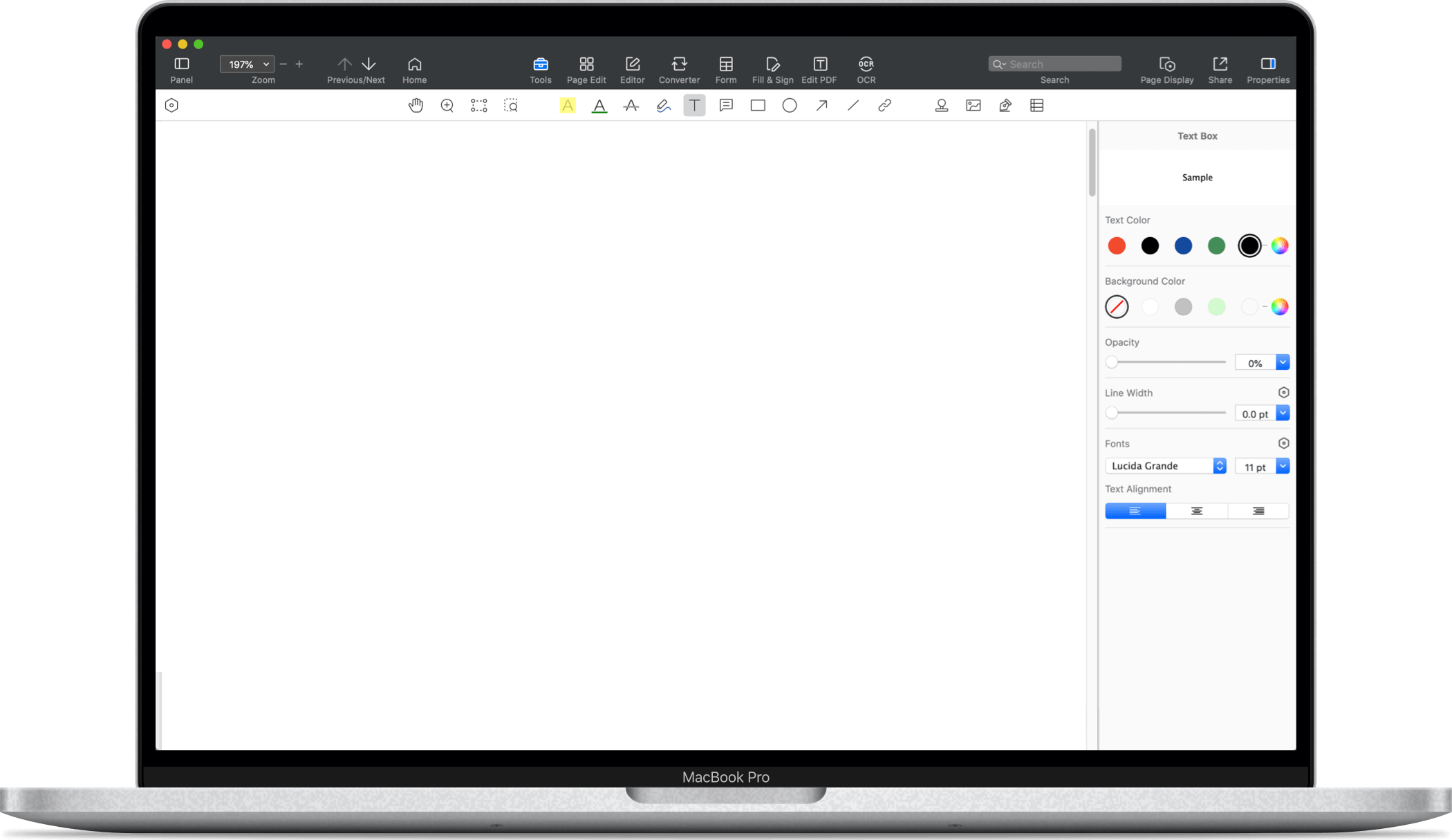

Download the latest version of PDF Reader Pro to edit a PDF version of the table above or make changes to our free templates:

Some Helpful Legal Templates

On your journey towards understanding liquidity and getting your affairs organized, you may want to consider other legal documents such as the one below:

Liquidity in life insurance is a valuable feature that can provide you with financial flexibility.

By understanding how liquidity works and using it to your advantage, you can make your life insurance policy work for you.

Free Download

Free Download  Free Download

Free Download