Correctly Fill and Sign a Letter of Intent

A Letter of Intent (LOI) is a document used in various business and legal contexts to outline the preliminary understanding between parties involved in a transaction or agreement.

Whether you're expressing interest in a business partnership, outlining terms for a potential acquisition, or setting the groundwork for a real estate transaction, knowing how to correctly fill out and sign a Letter of Intent is crucial.

How to Sign a Letter of Intent

Here’s a detailed guide to help you navigate this process effectively:

1. Understand the Purpose of the Letter of Intent:

Before you start drafting or signing, it’s essential to grasp the purpose of the Letter of Intent. Typically, an LOI serves several key functions:

| Expressing Intent | It demonstrates serious interest in pursuing a business deal, partnership, or transaction. |

| Outlining Terms | It outlines the preliminary terms and conditions that both parties intend to negotiate and finalize. |

| Setting Expectations | It establishes a framework for further discussions, due diligence, and the drafting of formal agreements. |

2. Components of a Letter of Intent:

A well-crafted Letter of Intent typically includes the following components:

| Header | Include the date and the parties’ names and addresses at the beginning. |

| Introduction | Clearly state the purpose of the letter and the transaction or agreement being contemplated. |

| Terms and Conditions | Outline the key terms and conditions that both parties intend to negotiate. This may include price, timeline, responsibilities, confidentiality provisions, etc. |

| Exclusivity (if applicable) | Specify if there is an exclusivity period during which negotiations are exclusive to the parties involved. |

| Due Diligence | Mention any due diligence activities that may follow the signing of the LOI. |

| Closing | Conclude with a statement of intent to move forward with negotiations in good faith. |

3. Tips for Filling Out a Letter of Intent

Here is a list of tips you can use to make your letter more professional and effective:

| Be Specific | Clearly define the terms, conditions, and expectations to avoid misunderstandings. |

| Use Clear Language | Write in clear, concise language that is easy to understand. |

| Be Realistic | Ensure the terms outlined in the LOI are achievable and realistic based on the current understanding of both parties. |

| Consult Legal Counsel | If necessary, seek legal advice to ensure the terms are legally sound and protect your interests. |

4. Signing the Letter of Intent:

When it comes to signing the LOI, follow these important steps:

| Signature Block | Include signature blocks for all parties involved in the transaction. |

| Date | Each party should date their signature to indicate when they signed the document. |

| Witnesses or Notary (if required) | Depending on the jurisdiction or the complexity of the transaction, signatures may need to be witnessed by a third party or notarized. |

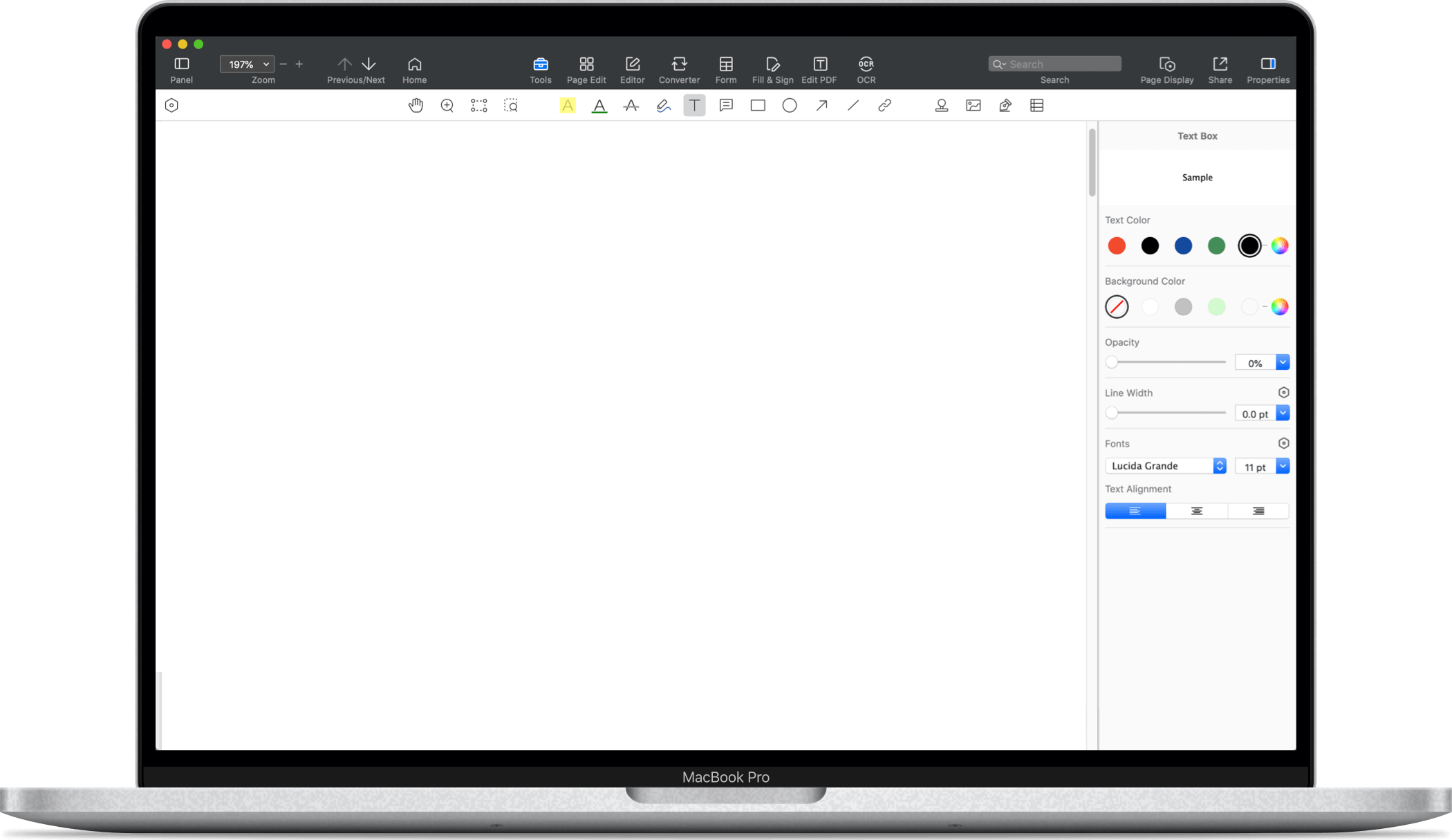

Download the latest version of PDF Reader Pro for Windows or Mac. This will allow you to edit and export your Letter of Intent.

Other Documents to Consider

When preparing a Letter of Intent (LOI) for a business transaction, several additional documents may be necessary or helpful to ensure clarity, legal protection, and thoroughness.

Here are some key documents to consider alongside a Letter of Intent:

-

Confidentiality Agreement (Non-Disclosure Agreement - NDA):

-

Purpose: If sensitive information will be exchanged during negotiations, an NDA ensures that both parties agree to keep such information confidential.

-

Content: Specifies what information is considered confidential, the duration of confidentiality, and the consequences of breaching the agreement.

-

-

Term Sheet:

-

Purpose: Often used in mergers and acquisitions or financing deals, a term sheet outlines the basic terms and conditions of a transaction before a formal agreement is drafted.

-

Content: Includes key terms such as purchase price, payment terms, conditions precedent, and any other significant terms of the deal.

-

-

Due Diligence Checklist:

-

Purpose: Provides a roadmap for conducting due diligence on the business or assets involved in the transaction.

-

Content: Lists documents and information that the parties will exchange and review to verify the accuracy of representations made in the LOI and to assess the risks associated with the transaction.

-

-

Draft Purchase Agreement or Contract:

-

Purpose: A preliminary draft of the final agreement that will govern the transaction once negotiations are complete.

-

Content: Includes detailed terms and conditions agreed upon in the LOI, such as warranties, indemnities, closing conditions, and any specific provisions unique to the transaction.

-

-

Financial Statements and Projections:

-

Purpose: Provides a clear picture of the financial health and performance of the business being acquired or invested in.

-

Content: Includes balance sheets, income statements, cash flow statements, and future projections that support the financial aspects discussed in the LOI.

-

-

Escrow Agreement:

-

Purpose: Sets forth the terms under which funds or assets will be held in escrow pending the fulfillment of certain conditions or completion of the transaction.

-

Content: Specifies the escrow agent, the conditions for releasing funds or assets, and the responsibilities of each party.

-

-

Letter of Credit or Bank Guarantee (if applicable):

-

Purpose: Provides financial assurance or security for the obligations outlined in the LOI, especially in international transactions or large-scale agreements.

-

Content: Details the terms under which a bank will guarantee payment to a beneficiary (e.g., the seller) upon presentation of specified documents.

-

-

Regulatory Filings and Approvals (if applicable):

-

Purpose: Ensures compliance with regulatory requirements or obtaining necessary approvals before completing the transaction.

-

Content: Includes filings with government agencies, industry regulators, or authorities overseeing the transaction.

-

-

Legal Opinions or Advice:

-

Purpose: Provides legal analysis and opinions on the validity and enforceability of the terms outlined in the LOI.

-

Content: Offers guidance on legal risks, potential liabilities, and strategies for mitigating legal challenges throughout the transaction process.

-

-

Contingency Plans or Exit Strategies:

-

Purpose: Anticipates unforeseen events or changes in circumstances that could impact the transaction's completion.

-

Content: Outlines alternative courses of action or exit strategies if the transaction cannot proceed as planned, ensuring both parties understand their options.

-

By understanding its purpose, structuring it effectively, and ensuring correct signing procedures, you can navigate the initial stages of a transaction with clarity and confidence.

Free Download

Free Download  Free Download

Free Download