How to Fill Out a W4 Form

The W-4 form, a crucial document for all employed individuals, underwent significant revisions in 2020 by the Internal Revenue Service (IRS) to enhance transparency and accuracy in payroll withholding.

Understanding how to fill out this form correctly is essential, especially if you're embarking on a new job or experiencing changes in your financial situation.

Understanding the Revised W-4 Form

The revised W-4 form, effective since December 2020, no longer requires employees to state personal or dependency exemptions, which are now obsolete.

Take a look at our guide on how to fill out the PCL-5 PDF form effectively.

Instead, it focuses on the number of dependents you can claim and offers options to adjust your withholding based on various factors like additional jobs or eligibility for itemized deductions.

The W-4 form, which underwent a major revision effective from December 2020, has been simplified and refocused to better reflect contemporary tax situations. The new form no longer requires employees to declare personal or dependency exemptions, which became obsolete following changes in tax law, particularly regarding the standard deduction and child tax credit.

Emphasis on Dependent Claims and Tax Withholding Adjustments

The revised W-4 form centers on accurately calculating the number of dependents, which is crucial for determining eligibility for the child tax credit. This focus aims to ensure accurate withholding, aligning more closely with your tax liability.

Filing Status and Its Impact on Withholding

Your filing status – whether single, married filing jointly, married filing separately, or head of household – plays a significant role in determining the amount of federal income tax withheld from your paycheck. This status affects your standard deduction, taxable income, and potential eligibility for certain tax deductions.

Adjustments for Multiple Income Streams

For individuals with multiple sources of income, such as a highest-paying job along with self-employment income, the W-4 form provides options to adjust withholding. This is crucial for those with varied income sources, including retirement income, to ensure accurate withholding that reflects their total tax liability.

Accounting for Extra Withholding and Deductions

The form also caters to scenarios where extra withholding is necessary, such as when you have taxable income not subject to regular withholding like dividends or interest. Additionally, the form accommodates adjustments for itemized deductions beyond the standard deduction, impacting your taxable income.

Explore our resource guide on how to accurately fill out the W-8BEN form.

Understanding Tax Liability and Withholding

Accurate completion of the W-4 form is essential for ensuring that the amount withheld from your paycheck aligns with your actual tax liability. This accuracy is vital to avoid owing a significant amount at the time of your tax return or overpaying throughout the year.

Considerations for Special Situations

Special financial situations, such as having student loan payments or receiving Social Security benefits, also impact your tax situation. The W-4 form allows for adjustments to account for these variables, ensuring that your withholding accurately reflects your financial reality.

The revised W-4 form thus provides a more streamlined and adaptable approach to tax withholding, allowing for a more accurate reflection of an individual's tax situation, especially in light of the evolving tax landscape.

Filling Out the New W-4 Form

The updated W-4 form has five sections instead of the previous seven, streamlining the process.

Here's how to complete it:

Step 1: Personal Information Provide your basic details like name, address, and Social Security number. This section also requires you to specify your filing status – single, married, or head of household.

Step 2: Multiple Incomes or Higher Deductions This section is for those with additional income sources (like a second job) or circumstances that require different withholding amounts.

Step 3: Claiming Dependents Here, you enter the number of dependents, like children, in your household.

Step 4: Other Adjustments (Optional) This optional step is for other income or deductions not previously covered, such as income from investments or deductions from itemizing your tax return. This step allows you to fine-tune your withholding to better match your tax liability.

Step 5: Sign and Date the Form Finally, your signature is required to validate the form.

Key Takeaways:

- The information you provide on the W-4 determines the tax withheld from your paycheck.

- Accurate completion of this form ensures you neither owe much at tax time nor receive a large refund.

- The new form accommodates adjustments for personal situations, like additional income from a second job.

Take a look at our comprehensive guide on how to accurately complete and submit the 1099 form for your financial reporting needs.

Using a W-4 Form PDF Template

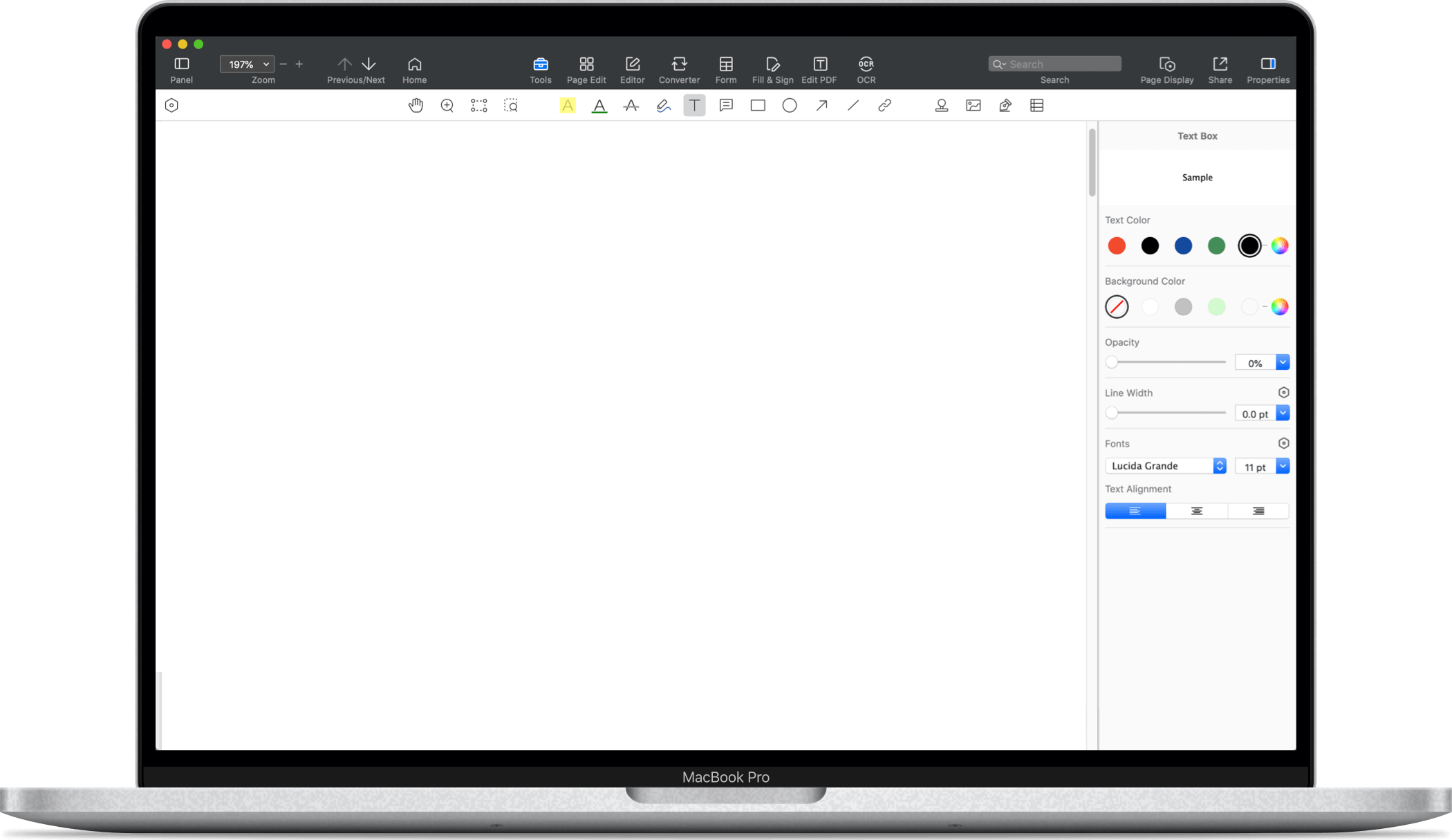

When it comes to filling out and managing your IRS Tax Form W-4, PDF Reader Pro offers an incredibly efficient and user-friendly solution.

Here are some key reasons why PDF Reader Pro's "IRS Tax Form W4" feature stands out:

- User-Friendly Interface: PDF Reader Pro's intuitive design simplifies the process of filling out the W-4 form, making it accessible and easy for users of all levels.

- Secure and Accurate Form Handling: The application ensures up-to-date compliance with tax regulations and offers robust encryption for the security of your personal data.

- Versatility and Convenience: PDF Reader Pro supports multiple document formats and allows easy editing, saving, and printing of your W-4 form, providing convenience and accessibility across various devices.

How to Fill Out a W4 Form: Best Practices

Understanding Your Financial Situation

Evaluate all income sources, tax filing status, and dependents. A thorough understanding of your financial situation ensures accurate completion of Form W-4.

Be Aware of Your Tax Filing Status

Select the correct tax filing status on the W-4. Whether you're a single filer, married, or head of household, this status significantly influences your tax rates and withholdings.

Consider Children and Dependents

Account for children under age 17 and other dependents on the W-4 to accurately reflect eligibility for tax credits like the child tax credit.

Avoid Common Missteps

Resist treating the W-4 as an interest-free loan by over-withholding for a larger tax refund. Accurate withholding balances immediate financial needs with tax obligations.

Update Form W-4 as Needed

Regularly update your W-4 with your employer, especially after major financial or personal life changes, to ensure withholdings reflect your current tax situation.

Use Available Resources

Leverage IRS withholding tables and calculators to determine appropriate withholdings and avoid underpayment penalties or overpaying tax throughout the year.

Single Taxpayer Considerations

Single taxpayers should review all sections of the W-4 carefully, even if their tax situation is straightforward, to ensure accurate withholding.

Review Annually Before Tax Season

Annually revisit your W-4 before tax season to confirm that your withholdings are still aligned with your current tax situation, avoiding any surprises.

How to Fill Out a W4 Form: FAQ

How Should I Report Income from Sources Like Freelance Work or Capital Gains on the W-4?

For income not subject to withholding, such as freelance income or capital gains, use Step 4 of the W-4 form. This section allows you to specify “non-job” income to ensure appropriate income tax withholding.

Can Joint Filers Use the Same W-4 Form?

Each individual must fill out their own W-4 form. Joint filers should consider the combined income from both partners when determining withholdings and complete individual forms accordingly.

What Is the Tax Withholding Estimator and How Can It Help?

The IRS Tax Withholding Estimator is an online tool that helps you determine the correct amount of federal taxes to be withheld from your paycheck, based on your specific income sources and individual situations.

Does the Current W-4 Form Account for Dependency Exemptions?

The 2023 W-4 form does not include sections for dependency exemptions. It focuses instead on dependents for purposes like the child tax credit and other tax considerations relevant to your annual income tax bill.

Should Single Tax Filers Pay Special Attention to Any Specific Sections of the Form?

Single tax filers, especially those with straightforward financial situations, should pay particular attention to Steps 2 and 4 of the 2023 Form W-4. These steps help adjust for additional income sources or deductions.

How Does Employer Identification Work on the W-4 Form?

Employer identification on the W-4 form involves providing your personal information in Step 1, ensuring that your income tax withholding and payroll taxes are accurately associated with your employment.

Are There Straightforward Questions on the Form to Guide Through Filling It Out?

The current W-4 form is designed with clear, straightforward questions in each section to guide you through the process of accurately reporting your income sources and tax situation.

Free Download

Free Download  Free Download

Free Download