How to Fill Out a 1099 Form

For businesses engaging with freelancers, gig workers, or self-employed individuals under contract in the United States, it's crucial to stay informed about your tax responsibilities. This includes understanding how to correctly file 1099 tax forms, such as the 1099-NEC and the 1099-MISC.

Properly handling these forms is vital for your business to avoid potential fines and penalties.

In this post, we'll guide you through the essentials of Form 1099 and ensure your business complies with the Internal Revenue Service (IRS) regulations during tax season.

- Understanding Form 1099

- Differentiating Between Form 1099-MISC and Form 1099-NEC

- Step-by-Step Guide to Completing Form 1099

- How Do I Get a 1099 Form?

- How to Fill Out a 1099 Form: Best Practices

- How to Fill Out a 1099 Form: FAQ

Understanding Form 1099

Form 1099 is used by businesses to report payments made to non-employees, like contractors or remote workers, to the IRS. This form is applicable only to U.S. workers.

For instance, a 1099 form is not necessary for a UK employee working in China but is required for an American contractor in China. The form requires detailed information about payments made during the tax year.

Differentiating Between Form 1099-MISC and Form 1099-NEC

The use of Form 1099-MISC and Form 1099-NEC has evolved over time. Here's what you need to know about these forms:

1099-MISC Form

Previously used for reporting contractor payments, the 1099-MISC form now reports other types of taxable income, such as rental income, prizes and awards, other income payments, and medical and health care payments.

1099-NEC Form

Since 2021, the 1099-NEC form has been reinstated to report payments for non-employee compensation. This form is specifically for reporting payments to contractors, freelancers, and other non-employees for services rendered.

Step-by-Step Guide to Completing Form 1099

Filling out a 1099 form can be straightforward with the right guidance.

Here's a step-by-step approach:

- Obtain a 1099 Form: You can acquire these forms from the IRS website or office supply stores.

- Fill in Payer and Payee Information: Include accurate details for both your business and the contractor.

- Report the Payment Amount: Clearly state the total amount paid to the contractor during the tax year.

- Submit the Form to the IRS and the Payee: Ensure both parties receive the completed form before the deadline.

Compliance and Deadlines

It's essential to submit Form 1099 by the IRS deadline to avoid penalties. Familiarize yourself with the current year's filing deadlines and plan accordingly.

Avoiding Penalties

Non-compliance with 1099 filing requirements can lead to fines. Stay informed about the potential penalties for late or incorrect filings.

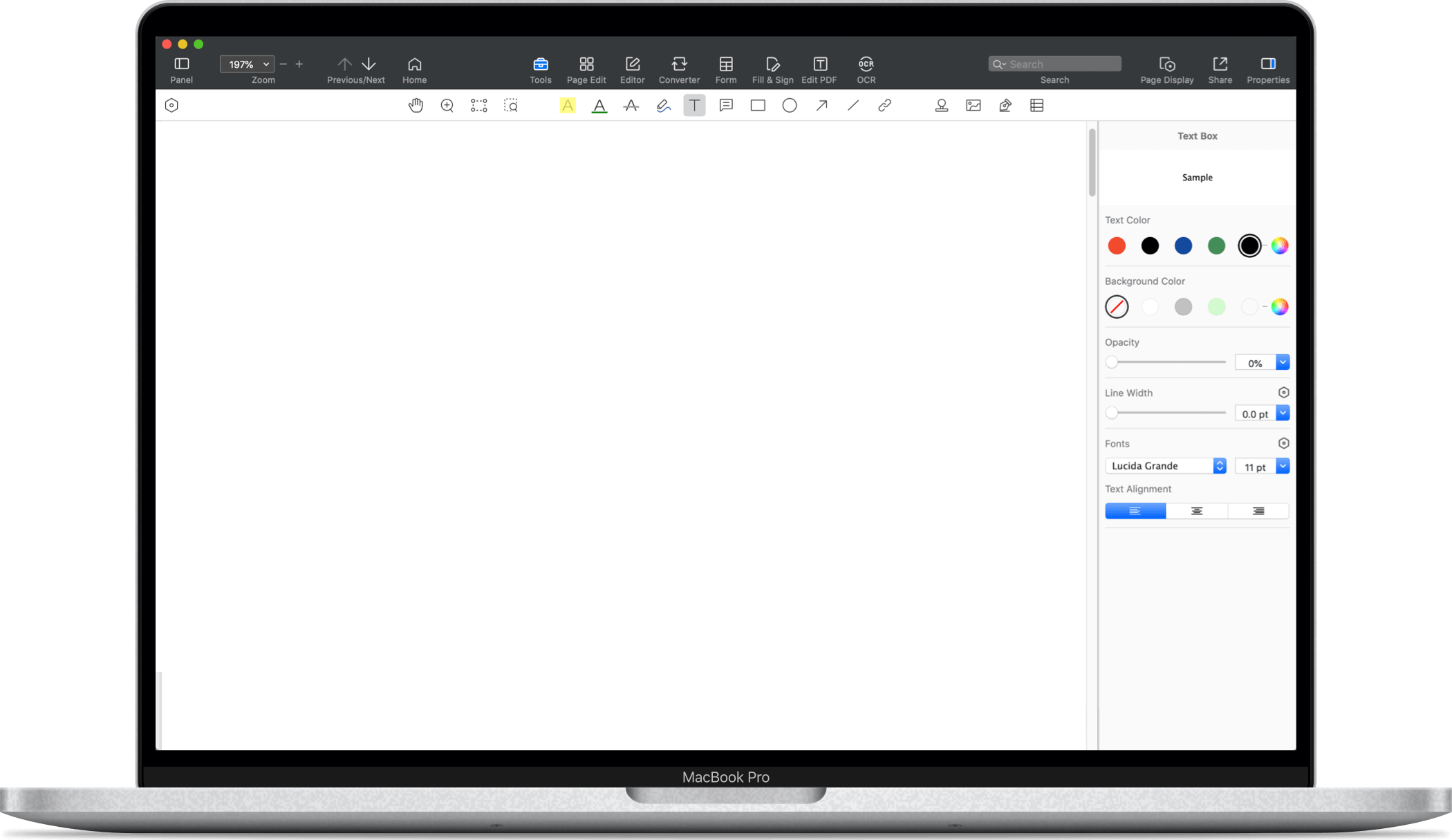

Staying compliant when hiring contractors is critical for any business. Using PDF Reader Pro, you can easily manage, fill out, and keep track of your 1099 forms, ensuring accurate and timely submissions. This tool streamlines the process, making it less daunting and more efficient for your business.

How Do I Get a 1099 Form?

Obtaining a 1099 form for your business needs is quite straightforward.

Here are the ways you can acquire this essential tax document:

-

Download from the IRS Website: The IRS website provides downloadable versions of all tax forms, including the 1099 forms. This is a quick and convenient way to get the forms you need.

-

Order Physical Copies from the IRS: If you prefer physical copies, you can order them directly from the IRS. This can be done through the IRS page dedicated to ordering tax forms online.

-

Contractors and the 1099 Form: It's important to note that contractors typically don’t need to download Form 1099 themselves. As a business or payer, you are responsible for sending the form to your contractors so they can complete it.

-

Using PDF Reader Pro's IRS Form 1099-MISC PDF Template: For an even more streamlined process, you can use PDF Reader Pro's "IRS Form 1099-MISC PDF Template". This template provides a pre-formatted document where you can easily fill in the necessary details. It’s particularly useful for ensuring that all required information is correctly and clearly entered.

How to Complete Form 1099 in 4 Steps

Completing Form 1099 accurately is critical to meet IRS requirements. Here's a simple four-step process:

Step 1: Fill Out Separate Form 1099s

Gather Form W-9 from each contractor to obtain the necessary information. Then, complete the Form 1099 with details like your business information, contractor's legal and business name, address, Social Security number or Tax Identification Number, and payment details.

Step 2: File Copy A with the IRS

Ensure that Copy A of Form 1099 is sent to the IRS by the deadline. Also, send Copy 1 to the relevant state’s Department of Revenue.

Step 3: Send Copy B to the Independent Contractor

Your contractor needs Copy B of the form to file their taxes. Make sure they receive it in a timely manner.

Step 4: Keep Copy C for Your Records

Retain Copy C of Form 1099 for your business records. It's essential for tracking your wage expenses for your company's tax return.

By following these steps and utilizing tools like PDF Reader Pro, you can efficiently manage the process of filling out and distributing 1099 forms, ensuring compliance with IRS regulations.

What is the Filing Deadline for Form 1099?

The filing deadline for Form 1099 with the Internal Revenue Service (IRS) is set for January 31st of each tax year. This date is crucial for businesses to remember to avoid penalties. In cases where January 31st falls on a weekend, the deadline is extended to the following Monday, providing a small window of additional time for filing.

What are the Penalties for not Filing Form 1099?

Failing to file Form 1099 by the deadline can lead to significant penalties, which are tiered based on how late the filing is made. Here are the details of the penalties:

-

Up to 30 Days Late: If the form is filed up to 30 days late after the deadline, the penalty is $60 per form.

-

31 Days Late to August 1st: Filing the form 31 days late but before August 1st incurs a penalty of $120 per form.

-

After August 1st or Not Filed: In cases where the form is filed after August 1st or not filed at all, the penalty increases to $310 per form.

-

Intentional Disregard: If there is intentional disregard for filing the form, the penalty is even steeper at $630 per form.

It’s important for businesses to be aware of these deadlines and penalties to ensure compliance with IRS regulations and avoid unnecessary fines. Using tools like PDF Reader Pro can help streamline the process of filling out and tracking Form 1099 submissions, ensuring timely compliance.

How to Fill Out a 1099 Form: Best Practices

When dealing with independent contractors, it’s crucial for a business owner to accurately fill out 1099 forms.

These forms are essential for reporting non-employee compensation and ensuring compliance with IRS filing requirements.

are best practices to consider when filling out 1099 forms, particularly the 1099-MISC and 1099-NEC forms.

Understand the Types of 1099 Forms

- 1099-MISC Forms: Used primarily for reporting various types of income like rent, royalties, prizes, awards, health care payments, and direct sales over $5,000.

- 1099-NEC Forms: Specifically for reporting payments made to independent contractors for services rendered.

Collect W-9 Forms from Contractors

Before you can complete a 1099 form, collect a completed W-9 form from each contractor. This form provides necessary information such as taxpayer identification, employer identification, and the contractor’s legal name and address.

Verify Contractor Information

Double-check the information provided by the contractors on their W-9 forms. Accurate taxpayer identification and employer identification numbers are crucial for IRS records and the contractor’s tax return.

Distinguish Between Various Types of Payments

Understand the different income payments:

- Independent Contractor Payments: Money paid for services rendered by a non-employee.

- Royalty Payments: Earnings from intellectual property or other assets.

- Broker Payments and Substitute Payments: Includes payments made in lieu of dividends or tax-exempt interest, and certain payments made by brokers.

- Health Care and Legal Services: Payments for medical services or legal fees.

Report the Correct Amount of Income

Ensure that the income reported on the 1099 form reflects the actual amount paid to the contractor. This includes any federal income tax, taxable income, or cash payments made during the tax year.

Meet Tax Season Deadlines

Be aware of the filing deadlines for the 1099 forms to avoid penalties. Generally, the forms must be filed with the IRS and sent to the contractor by January 31st.

Utilize Digital Tools for Accuracy

Consider using digital tools like PDF Reader Pro for filling out 1099 forms. These tools can help in maintaining accuracy, especially when managing multiple contractors.

Keep Records for Future Reference

Maintain a copy of each 1099 form you file. This is important for your business records and could be essential if there are any questions about your tax return or filings.

By following these best practices, you can ensure that your 1099 forms are accurately and efficiently completed, keeping your business compliant with IRS regulations during tax season.

How to Fill Out a 1099 Form: FAQ

Do I Need to File Form 1099-MISC for Retail Establishments?

If your business is a retail establishment and you make payments for products for resale, services, or other forms of compensation, you may need to file a Form 1099

-MISC. This is particularly relevant if you are making payments to an individual taxpayer or a buyer for resale that meet the IRS thresholds.

What are Aggregate Payments on a 1099 Form?

Aggregate payments refer to the total sum of payments made to an individual or entity during the tax year. When filling out a 1099 form, it's important to report the aggregate amount of all payments made to the contractor.

When Should I Use a Paper Form for Filing 1099?

You should use a paper form for filing 1099 if you are submitting a small number of forms or if you do not have access to electronic filing. However, for larger volumes, electronic filing is more efficient and is required by the IRS if you are filing 250 or more forms.

How is a 1099 Form Different from a W-2 Form?

A 1099 form is used to report income paid to independent contractors, while a W-2 form is used for reporting wages paid to employees. The type of form used depends on the nature of the relationship with the individual performing the work.

What Types of Payments Require Backup Withholding?

Payments that may require backup withholding include certain types of payments to contractors where the IRS has not received a taxpayer identification number. In such cases, the payer may be required to withhold a portion of the payment for income tax purposes.

Should Fish Purchases be Reported on a 1099 Form?

Yes, purchases of fish from anyone engaged in the trade or business of catching fish (aquatic life) should be reported on Form 1099-MISC if they meet the reporting threshold.

What is Reported Under Miscellaneous Income on Form 1099-MISC?

Miscellaneous income can include a variety of payments, such as rent, royalties, prizes and awards, and payments for health care services. It also includes golden parachute payments and certain earnings on amounts deferred.

Do Payment Settlement Entities Need to File a 1099 Form?

Payment settlement entities, such as credit card companies, are required to report payments made to merchants or contractors on Form 1099-K. This is specifically for payments made in settlement of reportable payment transactions.

These FAQs cover a range of common questions regarding the completion of 1099 forms, ensuring that businesses remain compliant with IRS regulations and accurately report various types of payments.

Filling out Form 1099 correctly is a crucial aspect of business operations, especially when dealing with independent contractors, service providers, or other non-employee compensations. It's not only a legal requirement but also an important part of your business records, ensuring accurate reporting of payments for services, real estate management, commission basis transactions, and other miscellaneous incomes.

Whether you're a property owner paying a real estate agent, a principal contract holder making deferred compensation payments, or a business making additional cash payments to vendors, understanding the specifics of Form 1099 is essential. It's important to be aware of the different types of 1099 forms and their specific uses, from reporting earnings on amounts deferred to payments to corporations and everything in between.

Remember, incorrect filing can lead to complications with the IRS, including backup withholding rules and issues with your income tax return. When in doubt, seeking legal advice or consulting with an attorney, especially in connection with complex scenarios like nonaccountable plans or payments in box specificities, is always advisable.

Finally, while tools like PDF Reader Pro can simplify the process of filling out and managing these forms, maintaining accurate and comprehensive business records is key. This ensures not only compliance with IRS reporting requirements but also provides a solid basis for your tax refund or other tax-related considerations.

In summary, the proper management and reporting of contractor payments and other forms of non-employee compensation are fundamental to the financial health and legal compliance of your business. By staying informed and diligent, you can navigate these requirements successfully.